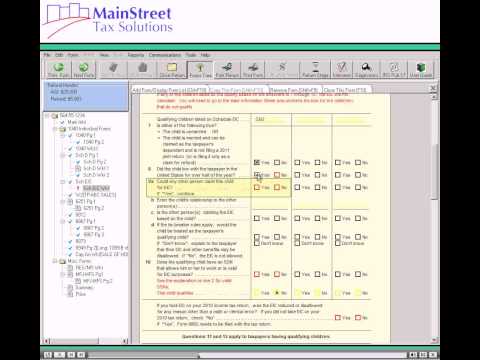

Hello and welcome to our software tutorial series. In this tutorial, we will go over how to calculate the Earned Income Credit using tax software. To begin, on the main information sheet, select the EIC check for any dependents who may qualify for the Earned Income Credit. If there is a qualifying child aged 19 or older, the scheduled ESC will be highlighted in red on the form stream. Go to this form and answer the questions regarding that child, which are on lines 4a and 4b at the bottom of the schedule. If the child was under age 24 and a student at the end of the tax year, select yes for question 4a. If the child was older than age 19 and permanently disabled, select yes for question 4b. Do not answer both of these questions; leave the one that does not apply blank. Answering both questions will cause an electronic filing error in Diagnostics. Next, we need to go to the Schedule EIC worksheet. Select the worksheet from the form stream. Questions 1 and 6 on the worksheet are calculated based on information entered on the main information sheet. Line 5 is calculated based on the amount of disqualified income from interest, dividends, rent, capital gains, and other types of income that have been entered in the return. Answer questions 4a and 6 by selecting the appropriate answer. Read the questions carefully before selecting the appropriate check. On line 2, select yes if the taxpayer has a social security number that allows them to work or is valid for ESC purposes. Otherwise, select no. If no is selected here, the tax software will not calculate an EIC. Select yes or no on line 4a to show if the taxpayer was a non-resident alien for any part of...

Award-winning PDF software

What is 8812 Form: What You Should Know

If you are subject to the alternative minimum tax (AMT), you should report income in Box 5b of Form 1040A and your adjusted household Eligible Businesses and Estates in 2018, or Taxpayers in 2017 The income limits for claiming the Additional Child Tax Credit are as follows: If you are a nonresident taxpayer who has a qualifying child who is a minor, you may also deduct child care expenses from your Eligible business and certain other income. See the Child and Dependent Care Expenses Deduction in Publication 23, Tax Benefits for Children and Dependents. For a married individual filing a joint return or a married individual filing separately, you'll need to Calculate or determine the credit. See the 2025 Children's Tax Credit table. Eligible Individuals and Estates.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8812, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8812 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8812 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8812 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Form 8812