Welcome to 1040return.com, the ultimate tax solution and the complete package for filing your tax returns. We provide you with easy-to-use and powerful software, as well as a wealth of tax resources at your fingertips. Visit us at 1040return.com today. This video will demonstrate how to use our innovative software to file a 1040a with a dependent. Let's get started. Here we are at 1040return.com. Let's begin an example on how to file a 1040a with a dependent. The program is designed to ask you questions so you don't miss anything. Click on the "Start for Free" button since we don't have an account. Create one by clicking on the "here" link. For this example, I will create a sample account. Don't forget to click on the Terms of Service Agreement below. When you're all set, press "Create Account" to get started. For this example, since John is taking care of a child, we will be using head of household for filing status. I'll be using sample information, but feel free to fill in your own information instead. Click on "Next" to proceed. On this page, we find a continuation of the "About You" section. Enter the information with sample telephone numbers in case there are any issues. The email address is already auto-filled. For occupation, we'll say that John Smith is a cook. Click "Next" to continue. Click on "No" for anyone who could claim you as a dependent. Then click "Next". John was not married in 2014, so we clicked "No" on this page. Enter John's sample address and click "Next" when ready. On this page, we type in "Baltimore" for John's School District and click "Next". In this example, we won't do anything with returned election, so we'll just hit "Save and Continue". Now that we have all...

Award-winning PDF software

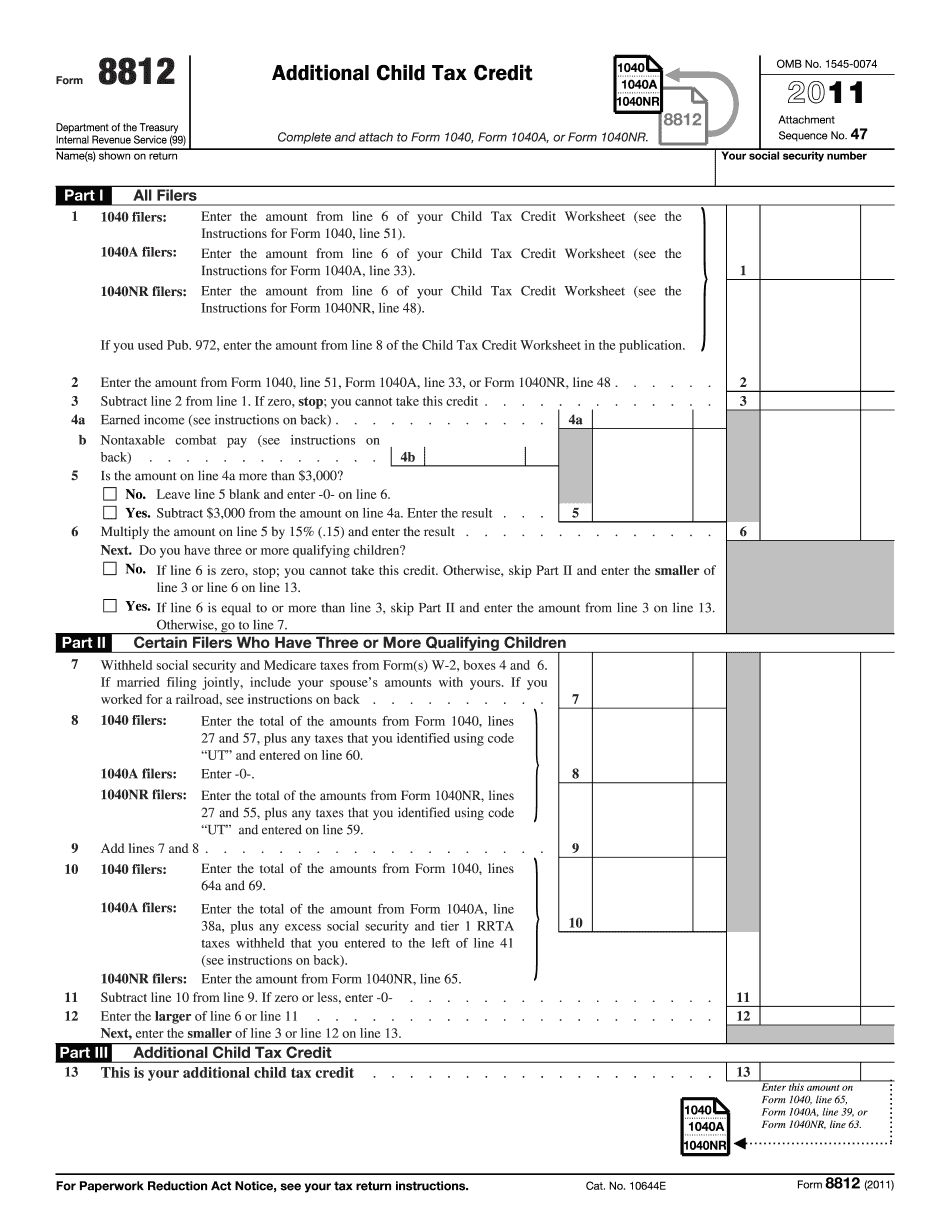

8812 instructions Form: What You Should Know

If you have not yet provided Form 1040, please fill out IRS Form 8812 using IRS Form 1040A (not 1040). If you are a current U.S. taxpayer and don't have one, you can also complete and submit the IRS Form 8812 using IRS Form 1040. Sep 21, 2025 — Use Form 1040 to calculate additional tax liability for the dependent child and any earned income of the dependent child. Form 0871-EZ (Explanation of Tax) 1. Enter on Line 33 of Form 8812 any child tax deduction(s) for a dependent child you file or have claimed and on Line 33a (see box number below) any itemized deduction for a dependent child you don't claim. Box 1: You are allowed to claim any amount for your child. Check here if you don't have children. (2) Enter on Line 33b any applicable state child tax credit for the dependent child. Box 2: Add any amount shown on Form 8863 for that child or line 33a and fill in the remaining boxes, to determine child tax credits, and additional child tax credit. Box 3: Your Adjusted Gross Income (AGI) for the dependent child (Form 1040-C and Form 1040A: Child Tax Credits). Box 4: The income limit for the child in the last box on line 33a of Form 8812 if you're using the standard or itemized deduction method. Box 8: Your Modified Adjusted Gross Income (MAGI) for the child for the last box or Line 33b if you're using the standard deduction method. Box 9: The standard child dependent exemption. Box 10: A statement that you are claiming a child credit on Schedule C (Form 1040). Box 11: A statement that the child is your dependent for federal income tax purposes, not as a dependent for employment tax purposes. Box 12: Reportable earnings from self-employment or trade or business. Box 13: Form 8812, the Alternative Tax with the same name as Form 1040, or a statement that you must use your Form 8812 to figure tax on a child tax credit. Box 15: Report of your earnings, including any earnings with respect to certain types of business income, such as interest, dividends, and rents, interest and dividends from securities and commodities.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8812, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8812 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8812 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8812 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8812 instructions