Award-winning PDF software

Concord California Form 8812: What You Should Know

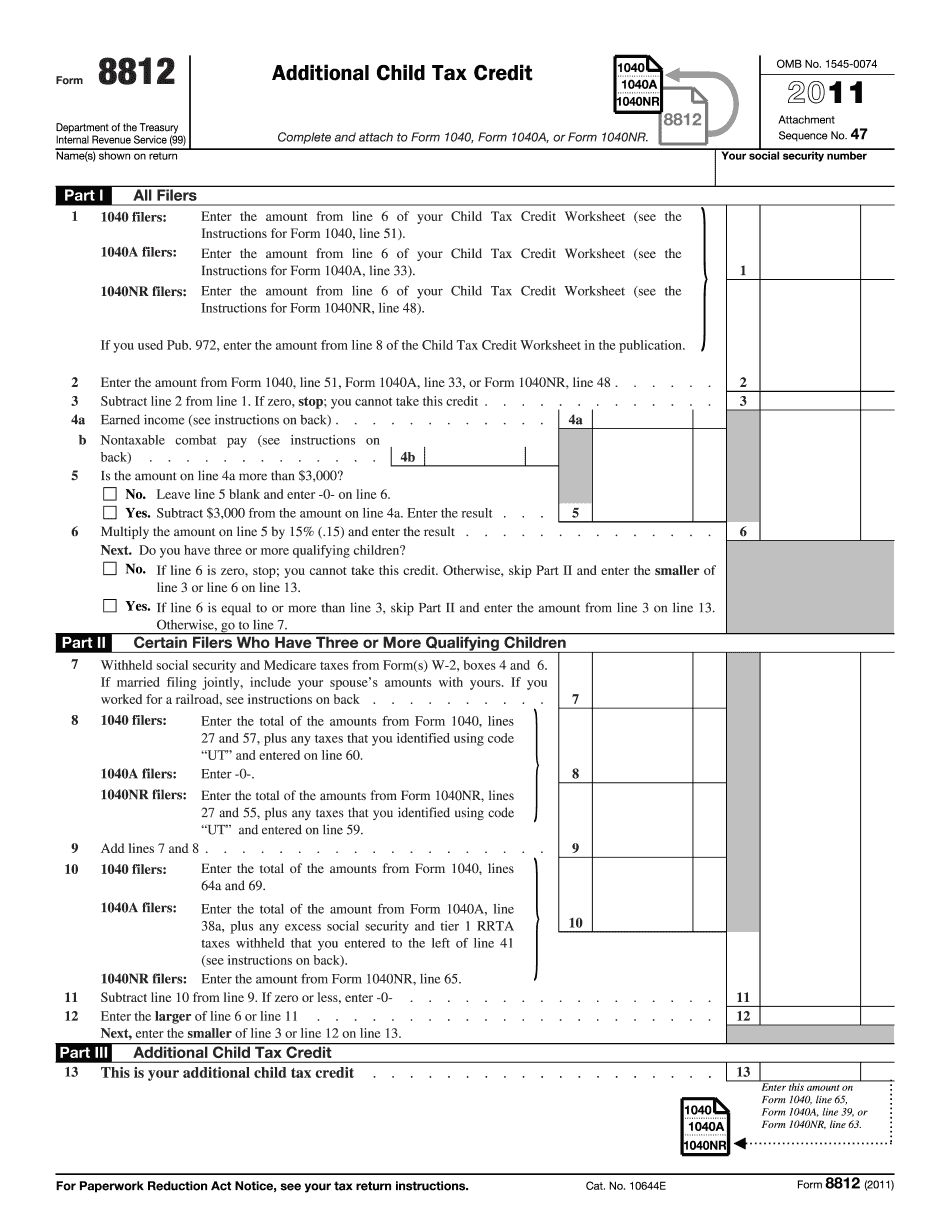

Calculating Additional Child Tax Credits with Schedule 8812 Form 8812 is a single-page sheet of paper that the IRS sends taxpayers to get the forms completed for them. Schedule 8812 (Form 1040), Additional Child Tax Credit, also known as Child Credit… is used to calculate the additional child tax credits to which you are entitled. These credits, known as the additional child tax credit or ADD-A credit, are a dollar-for-dollar credit against the Social Security, Medicare, or Railroad Retirement tax for children born in a certain tax year. Each child born in 2025 or later can be awarded up to 2,000 in annual credits. Child Tax Credit, ADD-A Credit, Calculation The child tax credits are equal amounts of: — 2,000 for a head of household filing jointly — 1,050 for an individual living alone — 1,000 for each qualifying child Child Tax Credit, ADD-A Credit, Calculation Example This example accounts for married families filing jointly with two children. If you are married filing separately, follow the below steps to calculate the child tax credit on Schedule 8812: The first step is to figure your child's adjusted gross income (AGI), the amount reported on your federal tax return. In the example, your AGI is 60,000. You reported 20,000 for business and 10,000 in rental income. Your AGI must equal 74,800 in 2025 (your filing status is married filing jointly). The second step is to determine the number of qualifying children. Each qualifying child must be one year old on the beginning date of the tax year for which you are claiming credits and at least 15 months old on or before the beginning of the tax year for which you are claiming the ADD-A credit. You may use this figure to complete Schedule 8812. Third step is the step that's usually used. You report the income you and your children will receive from work or rental income. That is the amount of rent, royalties, tips, bonuses, stock options, and income from any other sources that is to be given as a cash bonus to your children; that is to be withheld from their paychecks; that is to be transferred from one bank account to another.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Concord California Form 8812, keep away from glitches and furnish it inside a timely method:

How to complete a Concord California Form 8812?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Concord California Form 8812 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Concord California Form 8812 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.