Award-winning PDF software

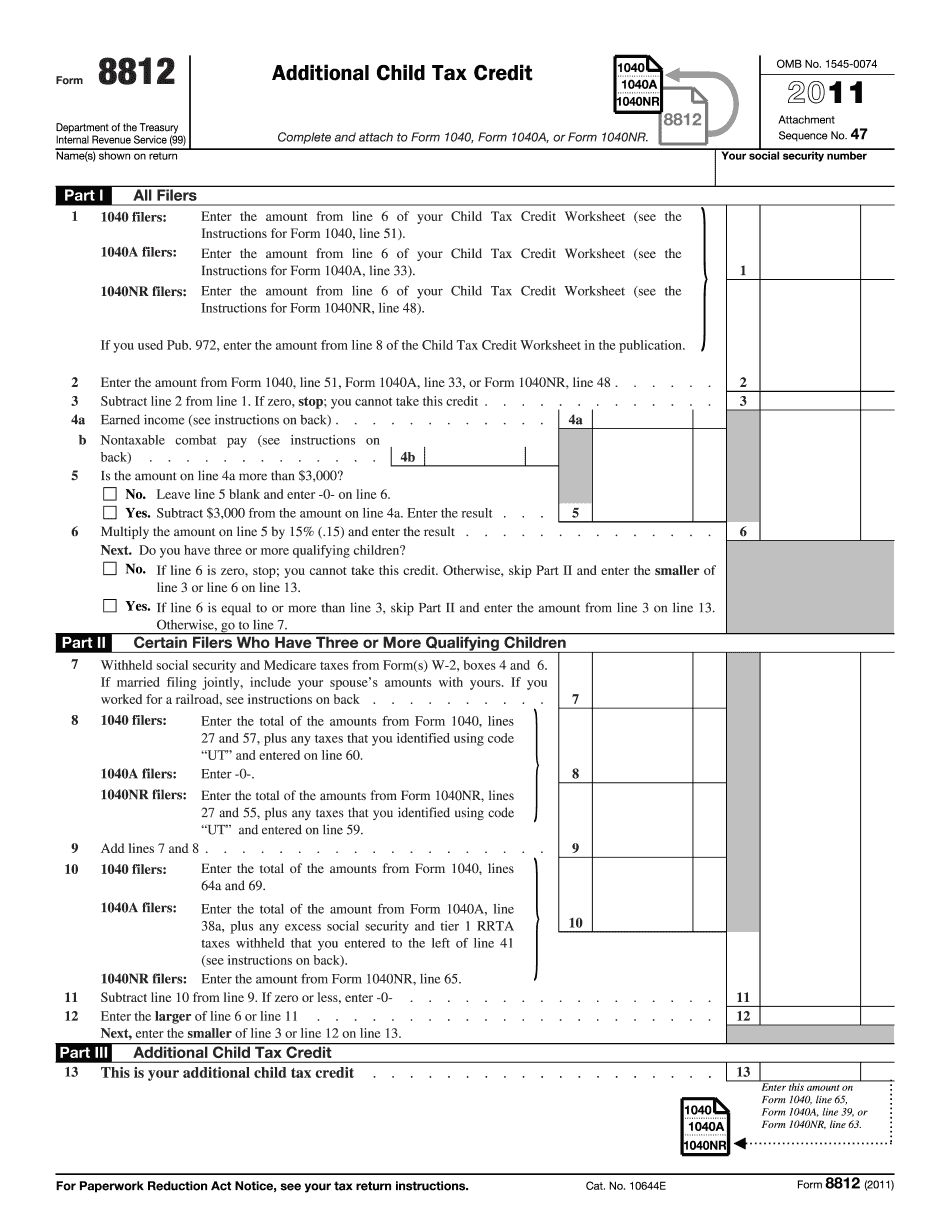

Form 8812 Arlington Texas: What You Should Know

For 2017 Tax year, an additional child tax credit is available for a child born before January 1, 2017, if, because of that child's birth, the taxpayer's adjusted gross income is 20,000 or less. An additional child tax credit calculation is made by first dividing the total standard deduction claimed by the number of qualifying children plus 4,050 for each qualifying child. If no children are claimed, then the standard deduction can be computed by applying the total limitation allowed for personal exemptions to the amount of tax actually paid. A nonresident alien parent's standard deduction that is greater than the credit allowable for a qualifying child is not subject to the credit limitation if the nonresident alien parent has an itemized deduction for expenses paid by that parent to the U.S. The child of a dual-status person can only be a nonrefundable personal exclusion amount for a qualified child. All such amounts are subject to the regular exclusion amount; this is the number of the child's basis in his or her estate, but limited to the value of property if the parent or parents of the qualifying child have died. For 2025 the following amounts will be refundable: · Exclusion for Qualifying Child · Exclusion for Qualifying Spouse If a person has more qualifying children than he or she has exemptions, the number of exemptions is not taken into account. Tax Payment The IRS provides a schedule to show the payment due or tax payable on a Schedule 8812 or Form 1040. Form 8822 (Form 1040) If a person is in a certain tax bracket and lives in another bracket, then the two will share the same tax percentage, which is adjusted for inflation. Example : You are a tax resident who lives in California from January 1st to December 31st. You have a taxable income of 45,000 for your tax year 2017. You work full-time at 70,000/year, and have a 1.00 EI Premium Tax Credit due of 400/month. Your tax bracket is from 31 to 39%. Your taxable income is 40,000. The EI Premium Tax Credit is increased by 1.00.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8812 Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8812 Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8812 Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8812 Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.