Award-winning PDF software

League City Texas Form 8812: What You Should Know

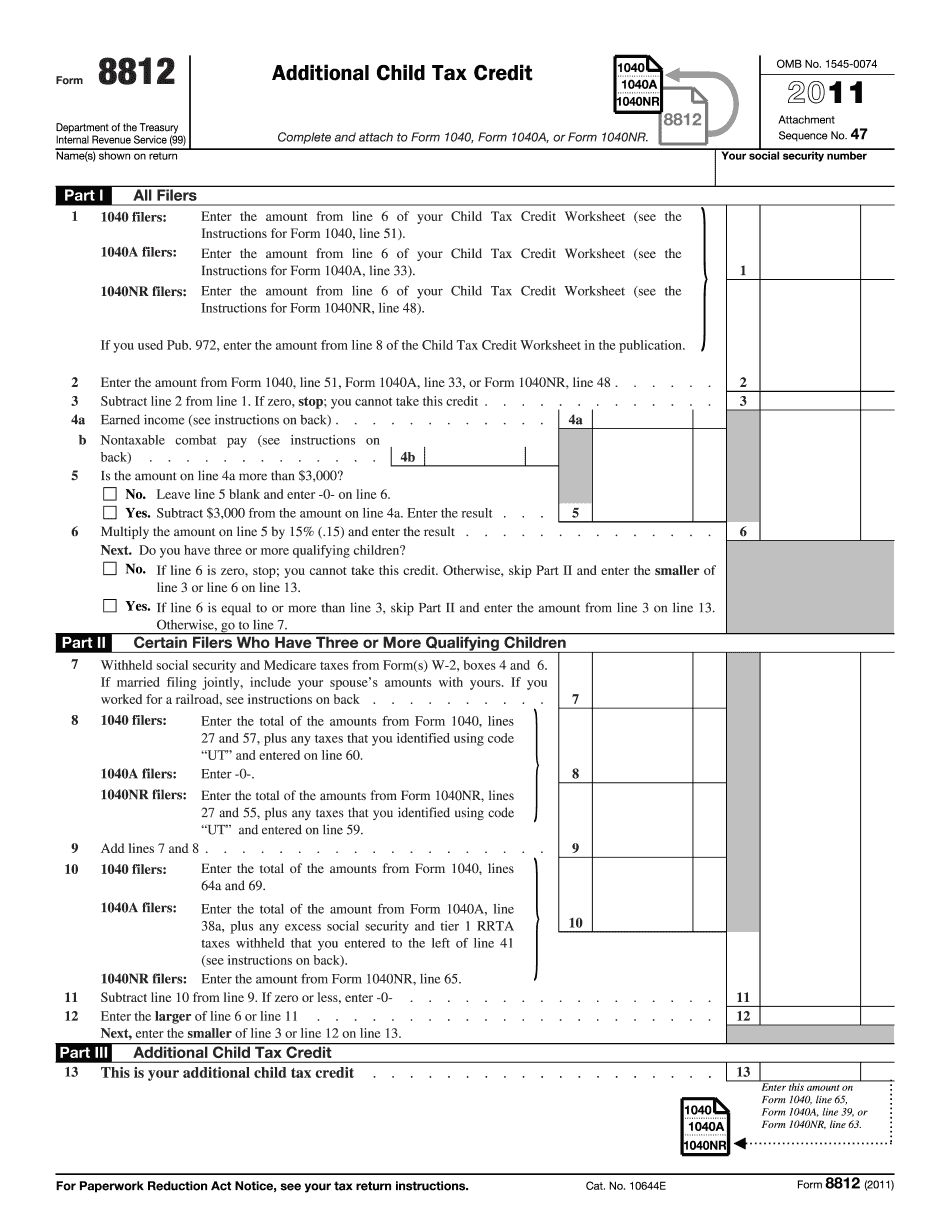

The schedule is an official IRS filing form and should be filled out by a tax professional. A tax professional may charge you a minimal fee to fill out Schedule 8812 (Form 1040) using your tax return. If your tax professional charges you for your service, you can get a free copy of Schedule 8812 and an estimated tax quote before your return is filed. Do not make a mistake and send all the right forms when the deadline is approaching! Schedule 8812 is an easily completed form, and we know that you want to minimize your tax bill this year. About Schedule 8812 (Form 1040). 2025 Schedule 8812 (Form 1040) — Forms to Use in 2018. Form 1040A and Form 1040EZ are tax forms that you may use to report on your income tax return the income you earned with your job. As an attorney, you work with all types of clients who are entitled to different tax-free income. One type of client is known as a nonresident alien whose only source of U.S. income is his or her employment. Other clients include foreign corporations with U.S. subsidiaries. The nonresident alien and foreign corporation may each have its own separate tax code and may therefore receive their own exemption and credit amounts. If you are a U.S. taxpayer or foreign entity with a U.S. subsidiary that is not engaged in U.S. net earnings income, your income is reported on Form 1040NR. To determine which Form 1040NR to report avoiding double reporting, first choose the year for which to report. Then choose the form. Form 1040NR was filed for the year you are a U.S. employer or agent. Form 3115 was filed for a foreign corporation that is not an employer, so there is no option for using Form 1040NR. Form 1040A is filed for the year the foreign corporation earns income. You may choose the Form 1040A. For more information on the employment test, see Publication 513, Withholding from Foreign Corporations. Also see Publication 521, Employer's Tax Guide for Tax Years Beginning in 2018. Form 3310 is a letter that you may send your employees informing them that their wages will be credited with the employment tax on Form 1040NR.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete League City Texas Form 8812, keep away from glitches and furnish it inside a timely method:

How to complete a League City Texas Form 8812?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your League City Texas Form 8812 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your League City Texas Form 8812 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.