Award-winning PDF software

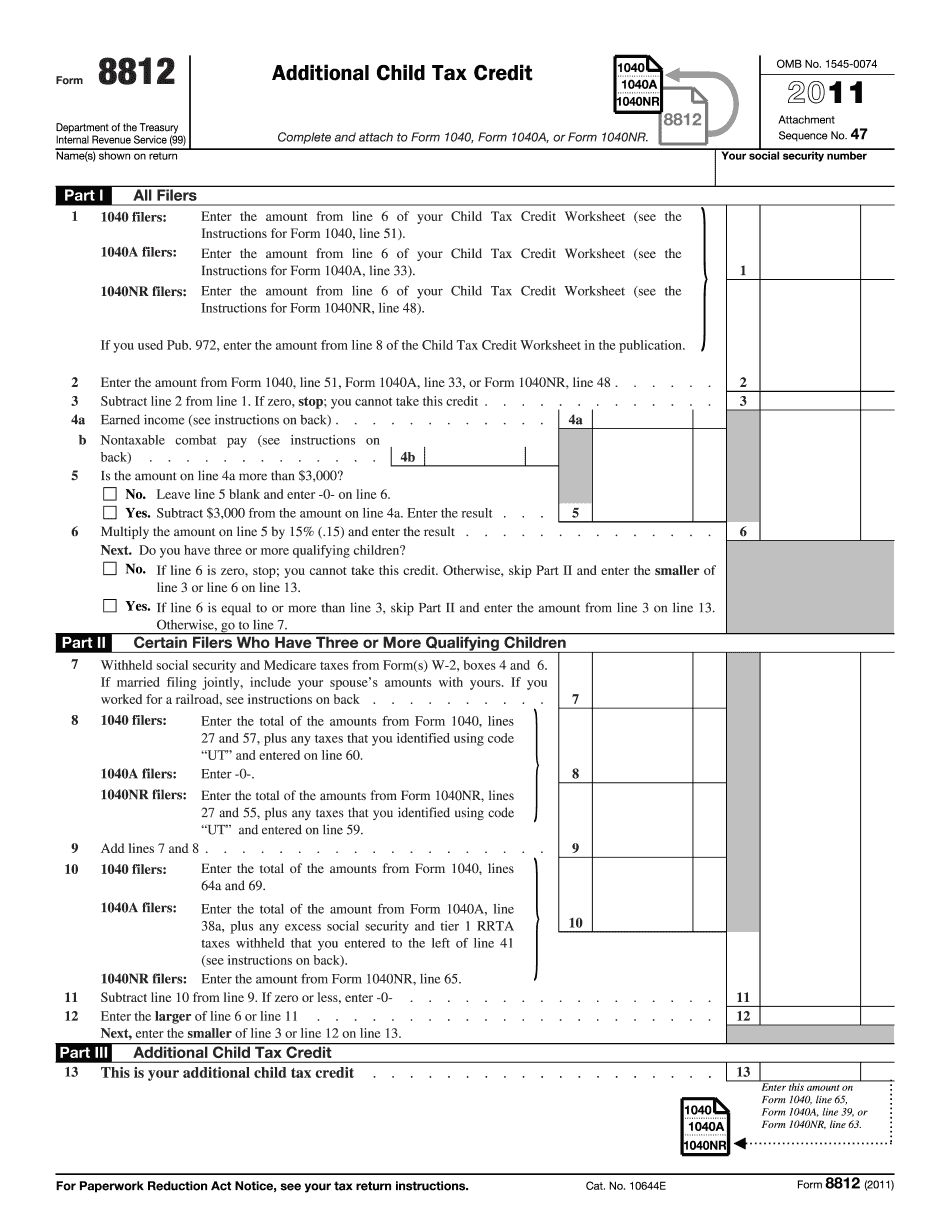

Printable Form 8812 Wichita Falls Texas: What You Should Know

Community Outreach. Contact: Toll Free:. Child Tax Credit Calculator is used to determine your child's tax credit based on filing status and number of qualifying children and how this applies to tax liability. The Child Tax Credit Calculator will calculate your child's tax credit based on filing status and number of qualifying children and will also show the child's tax liability in a table in the tax year. It will show tax credits, deductions, exemptions, and more. This is an excellent tool if you are planning on claiming one or more of the following credits, benefits, or deductions on your child's Federal or State income tax return for the taxable year for which this calculator is used. All information displayed represents the user's personal tax experience when using the calculator. This calculator is not meant for tax professionals. The calculator is a private tool that makes it possible for individuals to make informed decisions on filing status, number of qualifying children, as well as total and child tax liability. This calculator is not an official document or a substitute for the information on your tax return. You should consult a tax professional before making any changes to or deducting any amount from your federal, state, or local tax return, including the child tax credit. Use this calculator for federal tax purposes only. Use this calculator for state and local tax purposes only. Use this calculator for non-refundable child tax credit calculations only. The child tax credit is a tax credit for the amount of tax you owe on the total income of all qualifying children. This includes amounts paid to: the taxpayer in excess of the exemption amount the taxpayer by a qualifying person, a spouse, a qualified domestic partner, or any other taxpayer or eligible person or by any eligible person who was the taxpayer or qualifying person responsible for paying more than their share of the taxpayer's support during the taxable year and the year before for either parent (the child tax credit is a credit for one taxable year). This calculator was developed for the 2025 tax year. Use this calculator with tax years for prior year. The Child Tax Credit is a refundable tax credit. This means that you must have income in the month (usually February or March) in which you make the claimed refundable child tax credit to receive a refund for the year. Once you claim the tax credit, you cannot deduct any amount for it for that year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8812 Wichita Falls Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8812 Wichita Falls Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8812 Wichita Falls Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8812 Wichita Falls Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.