Award-winning PDF software

Form 8812 Texas Collin: What You Should Know

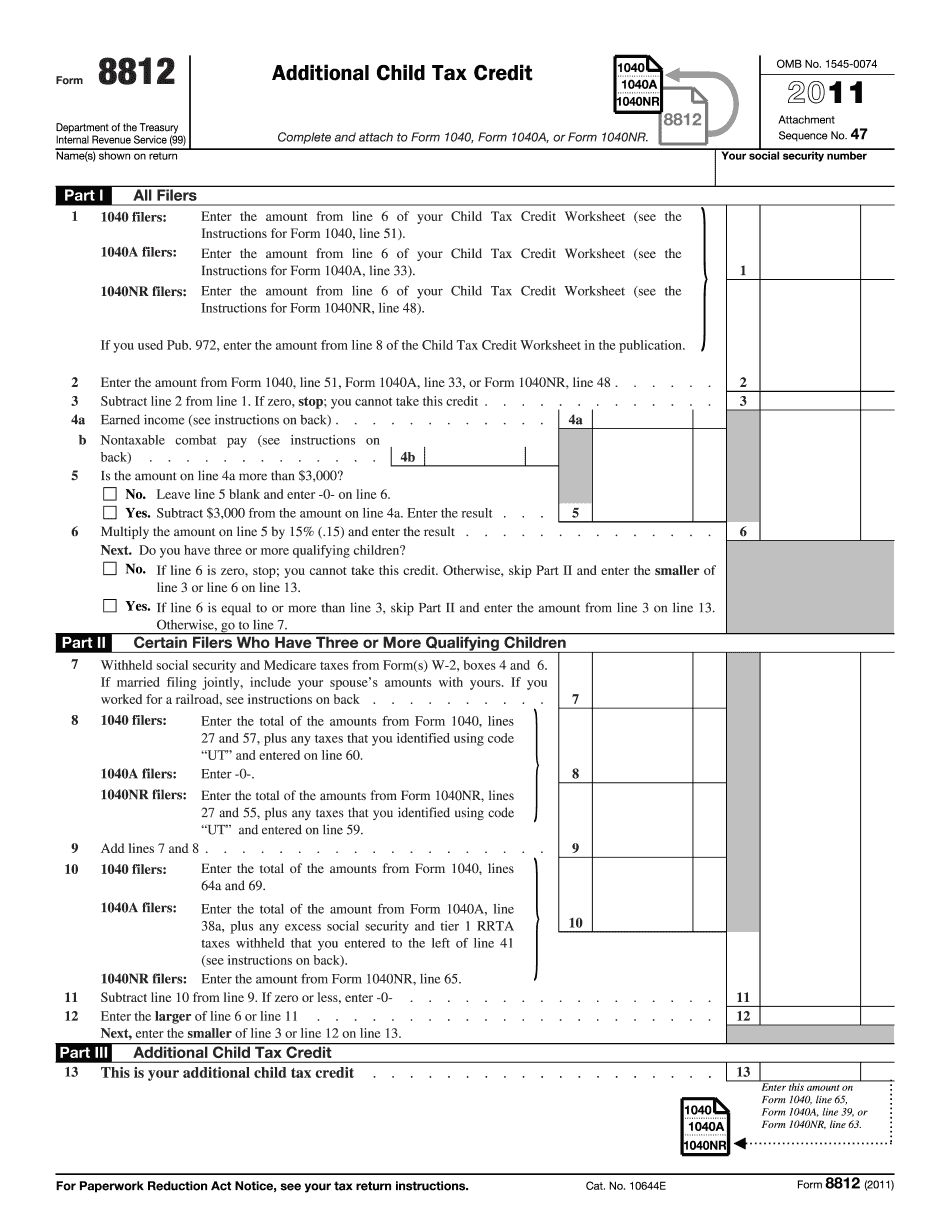

O. Box 8006 McKinney, TX 75070. (Motor Vehicles) (Toll Free: (Toll Free:) To find out what other Tax Forms are related to the Alternative Refundable Credit, click on. The form that is on 1040 is Schedule AB, “Alternative Refundable Credits.” You need to use the correct form to work with your local tax assessor. Schedule AB is also available on IRS Forms 1040, 1040A, and 1040EZ. You will need a copy of the Form 1040 for your county, and you will need to pay all required interest, penalties and certain other charges. See the instructions for Schedule AB from the IRS website on finding out whether The Texas Child Credit is Taxable If You Meet the Federal Poverty Level If Texas is your primary residence, you need to make sure the Text Child Tax Credit is Taxable If You Have a Disability For a child with a disability, see the section entitled “If You Have a Disability” which begins on page 30. For child care assistance, see the section entitled “Special Rules for Child Care Eligibility” which begins on page 31. Child Tax Credit Eligibility for Individuals Age 18-20 2,000 for the first child, 1,600 for each additional child Eligible children ages 19 and under may claim this credit for up to 4 children. The credit is not available for the following taxpayers: Filing status Single Married (filing separate) Head of Household Married, filing jointly Head of family who lives off joint assets Additional child credits apply up to age 26 You cannot take more than one credit, one for each child. The credit amount is computed as follows (note: If the income from more than 4 children does not equal the Federal poverty level, there is a limit based on your filing status.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8812 Texas Collin, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8812 Texas Collin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8812 Texas Collin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8812 Texas Collin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.